Tomorrow

is today's business

16 Oct 2025

Incoterms and Trade Credit Insurance: a strategic duo to secure your international sales

Article written by

Loïsa Catrice-Ranunkel

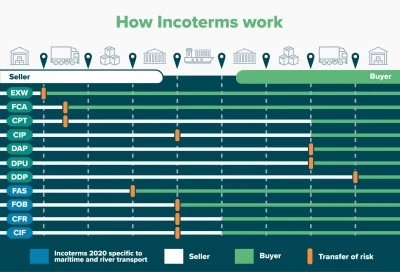

During a previous webinar organised by AU Group in collaboration with the law firm LHLF, we saw that choosing the right Incoterm is essential to identify which party is responsible for submitting customs declarations, accounting for VAT and paying import duties (customs, excise and VAT) to the importing country's Tax Authority. Let us now look at Incoterms in more detail and analyse their link with trade credit insurance.

Understanding Incoterms

Incoterms (International Commercial Terms), published by the International Chamber of Commerce (ICC), are international rules that clarify the respective responsibilities of the seller and the buyer in a cross-border transaction.

They define:

- the place and time of risk transfer,

- the allocation of transport, insurance and customs costs,

- the documentary formalities to be completed.

Important: Incoterms do not deal with the legal transfer of ownership of the goods. The transfer of ownership is defined by the sales contract or applicable law (often linked to full payment of the price). A retention of title clause, for example, allows the seller to remain the owner until full settlement, even if the buyer already bears the risks according to the chosen Incoterm.

Incoterms 2020 for all modes of transport

- EXW – Ex Works

- FCA – Free Carrier

- CPT – Carriage Paid To

- CIP – Carriage and Insurance Paid

- DAP – Delivered At Place

- DPU – Delivered at Place Unloaded

- DDP – Delivered Duty Paid

Incoterms 2020 spécific to maritime and inland waterway transport

- FAS – Free Alongside Ship

- FOB – Free On Board

- CFR – Cost and Freight

- CIF – Cost, Insurance, Freight

Trade Credit Insurance: definition

Trade credit insurance is a protection mechanism against the risk of non-payment of commercial receivables.

It covers:

- Commercial risk: insolvency, bankruptcy, prolonged payment default by the buyer,

- Political risk: war, embargo, expropriation, currency transfer restrictions.

Its advantages for the exporter:

- securing sales,

- protecting cash flow,

- facilitating bank financing (since the receivable is insured)

How do Incoterms & Trade Credit Insurance interact?

Incoterms and trade credit insurance serve two different yet complementary purposes:

- Incoterms organise the distribution of logistical risks and costs (transport, transport insurance, customs).

- Trade credit insurance protects against financial risk: the buyer does not pay the invoice, even if delivery has happened. Additional options may also cover the manufacturing risk, before the invoice is issued. In the event of order cancellation, and at the request of the insured, the entire transaction can be covered from contract signing to the debtor’s final payment obligation. In this case, regardless of the Incoterm, once the insured seller has fulfilled its obligations under the commercial contract, it is covered against compensated for financial losses occurring at any time, even before risk transfer and ownership transfer.

Not to be confused

Incoterms = transfer of physical risks

Transport insurance = coverage of goods against loss / physical damage

Trade credit insurance = coverage of non-payment risk, which may be extended to manufacturing risk

Transfer of ownership = contractual or legal clause (outside Incoterms)

Case studies & practical applications

Case 1 – EXW sale of machine tools (China)

A French SME sells EXW Lyon. The Chinese buyer organises transport and marine insurance. A few weeks later, it goes bankrupt.

- The buyer bore the logistical risks, but the seller was not paid. Only trade credit insurance covers the loss.

Case 2 – CIF wine export (United States)

An Italian exporter sells CIF New York. The wines arrive intact, but the American importer fails to pay.

- Transport insurance only covers physical damage. Non-payment risk is covered by trade credit insurance.

- Ownership may remain with the seller through a retention of title clause, but physically recovering the bottles proves to be impossible: only trade credit insurance provides protection.

Case 3 – FOB sale of car parts (Morocco)

FOB delivery in Marseille. After shipment, a political crisis blocks currency transfers in Morocco.

- The buyer bore the logistical risk, but the political risk is covered only by trade credit insurance.

Case 4 – DDP export of medical equipment (West Africa)

DDP delivery in Dakar. The seller bears the transport and customs duties + VAT. The hospital distributor defaults.

- Even with a retention of title clause, recovering the goods is unrealistic. Only trade credit insurance provides compensation.

Case 5 – CPT sale of textiles (Poland)

CPT delivery in Warsaw. The buyer disputes quality to delay payment, then files for bankruptcy.

- Trade credit insurance protects against non-payment once the quality dispute is resolved .

Case 6 – CIP export of electronic components (Brazil)

CIP delivery in São Paulo, with transport insurance included. But the Central Bank temporarily prohibits currency transfers.

- Only trade credit insurance covers this sovereign risk.

Case 7 – FOB grain export (Egypt)

FOB delivery in Rouen. Before payment, Egyptian banks block currency transfers.

- The risk is political. Trade credit insurance protects the seller’s cash flow.

Case 8 – EXW export within the European Union (Italy)

EXW delivery in Madrid. The Italian buyer collects the goods but goes bankrupt before payment.

- The delivery has been completed but ownership could remain with the seller. However, recovery of the goods is impossible. Trade credit insurance provides protection.

Distinguishing between logistics, property and finance

- Incoterms define logistical responsibilities and the transfer of physical risks.

- Transport insurance covers physical loss or damage.

- Transfer of ownership is a contractual matter (retention of title clause, applicable law).

- Trade credit insurance secures the financial aspect, in cases of insolvency, non-payment, or political risk.

Their combination forms a key pillar of export strategy, ensuring both control of physical flows and payment security.

Experience shows that the success of an export sale does not depend solely on product quality or the reliability of the seller and buyer. It relies on a clear understanding of the rules governing the movement of goods and the ability to anticipate risks, whether logistical, financial, or political.

Our advice

- Always to bear in mind the fundamental distinction between different categories of risk

Incoterms define the physical fate of goods, transport insurance preserves their physical integrity, while trade credit insurance is the true shield against non-payment. Confusing or neglecting any one of them undermines the entire transaction. - Choosing an Incoterm should never be purely technical.

It is both a commercial and strategic decision. Accepting an EXW too favourable to the buyer or a DDP too burdensome for the seller can turn an opportunity into a financial pitfall. Contractual balance is a condition of sustainability.

It is also worth recalling the value of a retention of title clause: it allows the seller, in the turmoil of non-payment, to maintain a strong legal position. Even if physical recovery of goods proves complex, it provides additional leverage in negotiation and claims.

Finally, no mechanism can replace human vigilance. Training employees to raise their awareness of the subtleties of Incoterms and the challenges of trade credit insurance, equips a company to navigate confidently through the sometimes uncertain seas of international trade.

Ultimately

Expertise in Incoterms and trade credit insurance is not just technical knowledge: it is the art of managing risk, combining caution and boldness to drive international growth.

Our news

22 Jan 2026

Press release -AU Group strengthens its presence in the SME and mid-cap market with the acquisition of Meurice Assurance-Crédit and GESCO

25 Nov 2025

Press release -New subsidiary AU Group México and appointment Gregorio Alcasena

Our CSR commitments

AU Group is committed to developing a sustainable world and economy by respecting people and managing natural resources.

Careers

We regularly recruit new talent to continue our development. Join a team of experts and become part of an international group which cares about its employees.