Tomorrow

is today's business

11 Dic 2025

Turkiye: B2B payments under pressure, bad debts on the rise

Economic environment in Turkiye

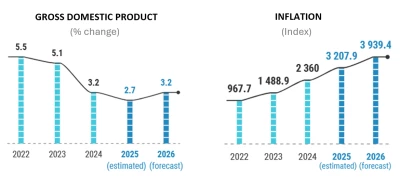

Strategically located between Europe and Asia, Turkiye has recently experienced significant economic volatility, marked by high inflation (averaging 58.6% in 2024, with a forecast of around 35.9% in 2025), currency depreciation, and external financial pressures. Persistent inflation, fuelled by exchange rate instability, has substantially increased production input costs and strongly impacted liquidity management. Nevertheless, Turkiye still holds potential thanks to its diversified economy, vast domestic market, and favourable geographic position for trade.

Outlook for 2026

According to the OECD, economic growth is expected to reach around 3.2%, supported by infrastructure projects and sustained exports despite ongoing inflationary pressures. Inflation should gradually stabilise thanks to tighter monetary and fiscal policies. However, insolvency risks are rising, particularly in industries such as steel, chemicals, and agri-food, as companies increasingly face liquidity problems and late payments.

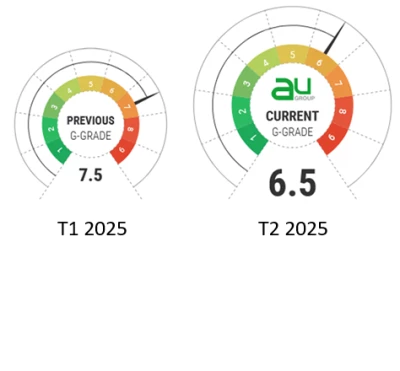

Turkiye has a G-Grade score of 6.5 in Q2 2025, reflecting a relatively high country risk, particularly regarding payment delays, economic instability, and operational challenges for businesses. However, this represents a moderate improvement compared to the 7.5 score in Q1 2025, indicating some stabilisation and increasingly favourable trading conditions compared to previous periods.

Our quarterly G-Grade indicator summarises country risk assessments conducted by credit insurers, providing an at-a-glance view of trends and risk levels for each country.

Turkiye’s regulatory framework is broadly aligned with EU standards but includes certain local specificities:

Elements

| Common practices |

|---|---|

Usual payment terms

| Generally 30-60 days |

Common guarantees

| Letters of credit, bank guarantees |

Late payment penalties

| Legally enforceable but often delayed |

Electronic invoicing

| Mandatory in certain sectors |

Private sector payment behaviour

Under current legislation, the theoretical payment term is 60 days, but it defaults to 30 days.

Payment delays have worsened significantly, affecting around 61% of B2B invoices. Bad debts have sharply increased, now representing approximately 10% of B2B invoice amounts. This results from liquidity pressures, particularly in competitive sectors where companies strategically use deferred payments and extended trade credit to protect market share and manage cash flow.

For documentary credit, avoid payment at the counters of a Turkish bank. Also, beware of the administrative burden of customs clearance operations.

Debt collection strategies

- Amicable recovery

Strongly recommended initially. Turkish companies generally prefer negotiation and mediation over immediate legal proceedings. Using local representatives can significantly improve debt recovery prospects. - Judicial recovery

Legal proceedings in Turkiye are lengthy, typically between 1 and 3 years. Asset seizure and court-ordered enforcement are possible but require persistent management and rigorous legal tactics to be effective.

Legal and cultural issues

The business environment prioritises personal relationships, trust, and diplomacy. Direct confrontation in the early stages of debt recovery is not advisable; mediation is preferred. Regional variations in legal practices require specialised local legal advice for effective debt collection.

Public sector focus

The public sector is more predictable but may experience administrative delays. Strict compliance with procedures and contractual requirements is essential for timely payment. Internationally funded projects generally carry lower payment risks compared to purely domestic initiatives.

Nuestras noticias

25 Nov 2025

Press release - New subsidiary AU Group México and appointment Gregorio Alcasena

17 Oct 2025

Incoterms and Trade Credit Insurance: a strategic duo to secure your international sales

Nuestros compromisos de RSE

(Responsabilidad Social Empresarial)

AU Group se compromete a desarrollar un mundo y una economía sostenibles, a través del respeto a los seres humanos y el manejo de los recursos naturales.

Espacio de carrera

Regularmente estamos reclutando nuevos talentos para continuar nuestro desarrollo. Únete ahora mismo a un equipo de expertos en gestión de cuentas por cobrar e intégrate a un grupo internacional de tamaño humano.