Tomorrow

is today's business

6 Feb 2026

Italy: Payment terms - a structural challenge for business

Economic environment in Italy

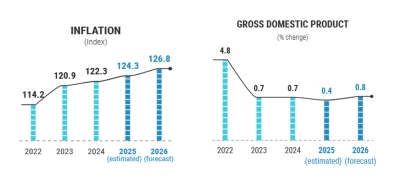

Italy, the third-largest economy in the eurozone, faced a mixed economic situation in 2025. After a post-COVID recovery phase, growth is slowing. The manufacturing sector, accounting for 15% of GDP, is struggling, and domestic consumption remains weak despite some signs of improvement.

The labour market, however, continues to improve. The unemployment rate fell below 6% at the end of 2024, according to the OECD—a historically low level. This trend, combined with targeted tax cuts and declining inflation, supports real disposable income. Household savings, still high in 2024 (12% of disposable income), are beginning to be spent, boosting demand.

Internationally, Italy has recorded a current account surplus since 2024, thanks to lower energy prices and strong tourism performance. Nevertheless, the fiscal situation remains fragile. Public debt is approaching 140% of GDP, and the deficit remains high, prompting the European Commission to place the country under an excessive deficit procedure. For now, market confidence and implicit ECB support help contain risks. The banking system, which is robust, also contributes to stability.

Outlook for 2026

Economic growth has remained weak in 2025, with an anticipated increase of 0.8%. Growth will be driven mainly by household consumption and progress on projects linked to the European recovery plan. Private investment, however, is slowing, particularly in the housing sector, affected by the gradual phase-out of the Superbonus scheme. Non-residential construction and infrastructure projects could offset this decline, provided EU funds are used more effectively, as less than half had been committed by the end of 2024.

Foreign trade remains a strong point of the Italian economy. Exports account for nearly 30% of GDP, with a strong focus on the European Union and the United States. External demand, however, remains fragile, notably due to the slowdown in the German economy and uncertainties surrounding US trade policies, such as the reintroduction of tariffs on certain industrial products.

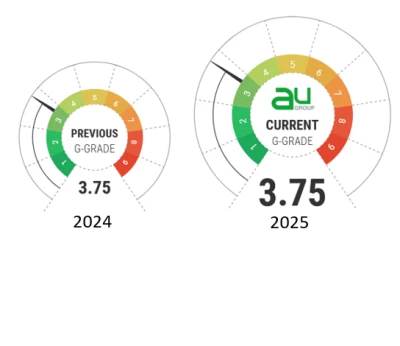

Italy maintains a G-Grade score of 3.75 in 2025, stable compared to 2024. This level reflects a moderate risk in intercompany credit. The legal framework is functional but slow, political conditions are broadly stable, and payment terms remain longer than the European average.

Notre indicateur trimestriel G-Grade est une synthèse des évaluations des risques pays, réalisées par les assureurs-crédit. Il permet de visualiser en un seul coup d’œil les tendances et le niveau de risque pour chaque pays.

Italy has a legal framework harmonised with the EU, although administration remains slow and judicial procedures complex.

Elements

| Common practices |

|---|---|

Usual payment terms

| 60 to 90 days. Compliance varies by region and sector. |

Payment methods

| Bank transfer (very common), Cambiale (bill of exchange), cheques (still frequent in the south), RI.BA. |

Common guarantees

| Accepted bills of exchange have enforceable value. Bank guarantees may be required depending on debtor risk. |

Late payment penalties

| The applicable legal rate is the ECB rate plus 8 points. Must be contractually agreed to avoid disputes. |

Electronic invoicing

| Mandatory, with specific formats and portals. |

Note: RI.BA. (Ricevuta Bancaria: deferred payment order sent to the debtor’s bank) is not a payment method but an electronic transmission tool for receivables. It can be effective with reliable clients but remains a simple acknowledgement of debt without legal value, offering no real recourse in case of non-payment.

Private sector payment behaviour

Payment delays remain frequent in Italy. They are mainly due to SMEs’ cash flow difficulties, heavy reliance on supplier credit, and the highly fragmented structure of the economy. In some southern regions, delays can reach or exceed 90 days. The number of unpaid invoices after 120 days is rising, particularly in construction, retail, and metallurgy. Conversely, large companies and international groups generally maintain good payment practices.

Public sector focus

Payment delays in the public sector have decreased but remain high in some local administrations. Tenders follow EU rules, but execution can be disrupted by budgetary delays. Digitalisation is progressing through the MEPA platform (Electronic Market of Public Administration), although its effectiveness varies significantly by region.

Debt collection strategies

- Amicable recovery

It remains the preferred solution. Written reminders, phone calls, and on-site visits are often effective. - Judicial procedure

Payment order (decreto ingiuntivo): A fast procedure if the claim is well documented. The debtor has 40 days to contest. / Simplified procedures: Suitable for simple, well-documented disputes /Ordinary procedures: Longer (up to three years) and costly

Once judgment is obtained, various enforcement measures are possible: seizure of movable or immovable property or third-party receivables. Decisions issued within the EU can be enforced in Italy under applicable EU regulations.

Italy has no commercial courts, so civil courts are congested, and judgments can take a very long time, especially if the debtor appeals.

Legal and cultural issues

The Italian judicial system is often considered slow, with outcomes sometimes varying by jurisdiction. Administration remains cumbersome, and procedures can be delayed by successive appeals.

In business, personal relationships play a key role. In family-owned SMEs, compliance with commitments largely depends on trust built between partners.

Since 2022, Italy has introduced the Business Crisis and Insolvency Code (Codice della Crisi d’Impresa e dell’Insolvenza), aimed at detecting financial difficulties earlier. This new framework requires companies to implement alert mechanisms and facilitates access to preventive restructuring procedures. It marks an important step in modernising Italian insolvency law.

Nuestras noticias

22 Ene 2026

Presse release -AU Group strengthens its presence in the SME and mid-cap market with the acquisition of Meurice Assurance-Crédit and GESCO

Nuestros compromisos de RSE

(Responsabilidad Social Empresarial)

AU Group se compromete a desarrollar un mundo y una economía sostenibles, a través del respeto a los seres humanos y el manejo de los recursos naturales.

Espacio de carrera

Regularmente estamos reclutando nuevos talentos para continuar nuestro desarrollo. Únete ahora mismo a un equipo de expertos en gestión de cuentas por cobrar e intégrate a un grupo internacional de tamaño humano.